Car insurance rates can often feel like a complex puzzle. Whether you’re buying a new car or renewing your policy, understanding why prices vary so dramatically is the first step toward saving money. Many factors influence your final premium, and being informed is your best strategy for getting a great deal.

You’re in the right place. This ultimate 2026 guide will decode the mystery behind insurance premiums. We will break down exactly what determines your quote and provide 9 proven secrets to help you secure the best possible car insurance rates for your vehicle in the UAE. Let’s dive in.

Comprehensive vs. Third-Party: How Your Choice Impacts Rates

First, it’s essential to understand the two fundamental types of coverage. Your choice here is the single biggest factor affecting your car insurance rates.

| Type of Insurance | What It Covers | Who It’s For |

|---|---|---|

| Comprehensive (الشامل) | Covers damage to your own car, fire, theft, AND damage you cause to others. | Drivers seeking complete peace of mind, and it’s often mandatory for financed cars. |

| Third-Party Liability (ضد الغير) | Only covers injury or damage you cause to other people’s property. It does NOT cover your own car. | The legal minimum requirement, suitable for older, lower-value cars. |

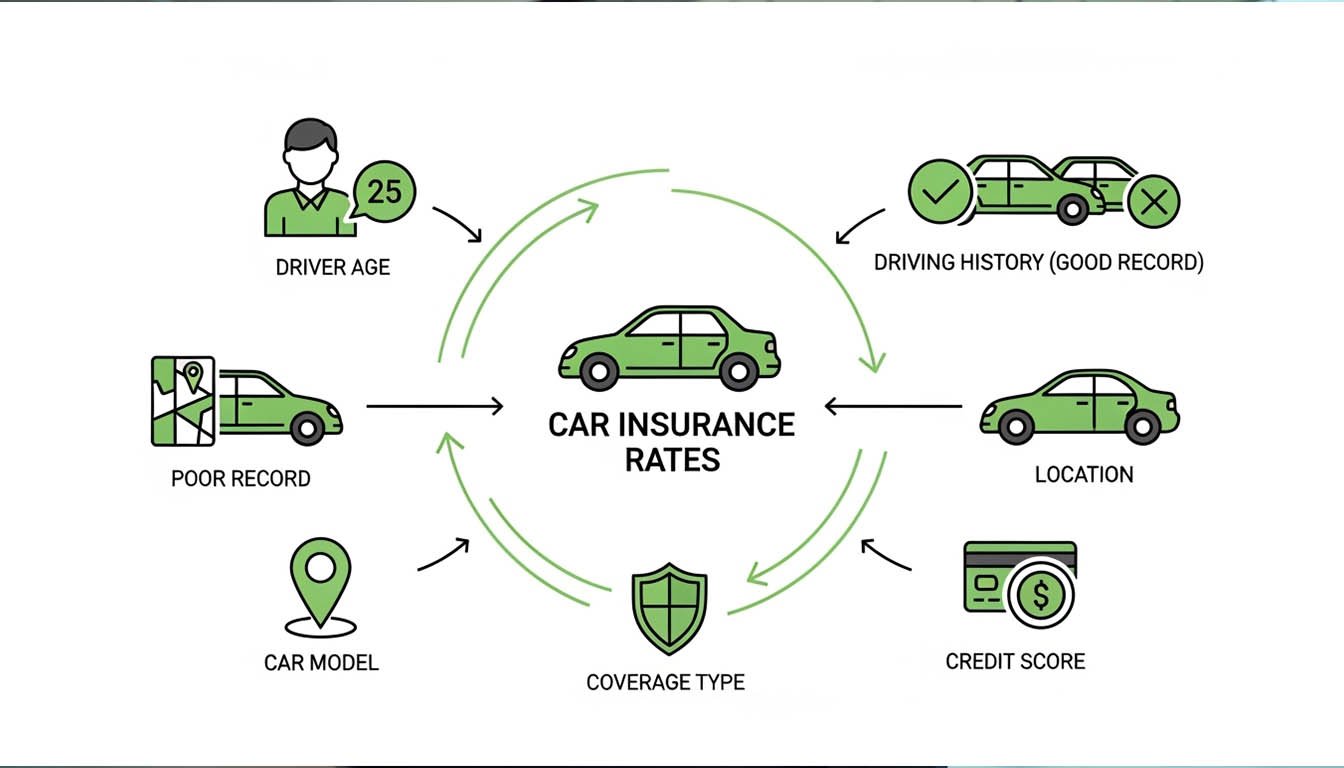

What Factors Determine Your Car Insurance Rates?

Insurance companies are all about risk assessment. The higher the risk you represent, the higher your premium. Here are the key factors they evaluate to calculate your car insurance rates in the UAE.

1. Your Car’s Value, Make, and Model

An expensive luxury SUV with high-cost spare parts will have higher car insurance rates than a standard sedan. Sports cars also attract higher premiums due to the perceived risk of accidents.

2. The Driver’s Age and Driving Experience

Insurers consider drivers under the age of 25 to be higher risk, so they often face steeper car insurance rates. Conversely, an experienced driver over 30 will be offered more favorable premiums.

3. Your Driving History (No-Claims Discount)

A clean driving record is your best asset. As mandated by UAE traffic laws, safe driving is rewarded. For every year you drive without making a claim, you earn a “No-Claims Discount” (NCD), which substantially reduces your premium. You can learn more about traffic regulations from the official RTA website.

4. Agency Repair vs. Non-Agency Repair

Choosing an “agency repair” clause increases your premium because dealership repairs are more expensive. Opting for repair at a network of approved high-quality garages can significantly lower your car insurance rates.

9 Proven Secrets to Get Cheaper Car Insurance Rates

Now for the actionable part. Here are proven strategies to lower your costs.

- Compare Quotes Relentlessly: Never accept the first quote. Use online comparison platforms to compare offers from multiple insurers. This is the single most effective way to find better car insurance rates.

- Build Your No-Claims Discount: Drive safely. It’s the best long-term strategy.

- Choose an Older, Reliable Car: A certified used car often has lower insurance costs. Find your perfect match in our collection at Arabity Online.

- Increase Your Deductible: If you’re a safe driver, agreeing to a higher deductible (the amount you pay first in a claim) will lower your premium.

- Pay Annually: Paying your premium in one go can save you from administrative fees charged for monthly installments.

- Drop Unnecessary Add-ons: Review your policy. Do you really need GCC cover if you never drive outside the UAE? Removing extras you don’t use will cut costs.

- Choose Non-Agency Repair: For cars older than two or three years, opting out of agency repair can lead to major savings on your car insurance rates.

- Inquire About Group Discounts: Some employers or professional associations have deals with insurance companies. It never hurts to ask.

- Stay Informed on Market Trends: Prices in the insurance market can fluctuate. Staying aware of trends, as reported by outlets like Gulf News, can help you negotiate better at renewal.

Frequently Asked Questions (FAQ)

Let’s clear up some common questions about car insurance rates.

Is car insurance mandatory in the UAE?

Yes, it is absolutely mandatory. You cannot register a car in the UAE without having at least a valid Third-Party Liability insurance policy. Driving without valid insurance can lead to heavy fines and black points.

What is a deductible/excess in car insurance?

A deductible, or excess, is the amount of money you have to pay out-of-pocket for a claim before the insurance company pays the rest. A higher deductible usually leads to lower car insurance rates.

Does my driving history affect my car insurance rates?

Absolutely. A clean driving history with no claims allows you to earn a No-Claims Discount (NCD), which is one of the most effective ways to lower your car insurance rates over time.

Conclusion: Taking Control of Your Car Insurance Rates

While some factors are fixed, you have significant control over your car insurance rates. By understanding what insurers look for, driving safely, and making smart choices about your car and coverage, you can ensure you’re getting the best deal possible.

Now that you’re an expert, the next step is to find a car that’s not only great to drive but also economical to insure. Browse our curated collection of certified vehicles at Arabity Online today!